ending work in process inventory calculation

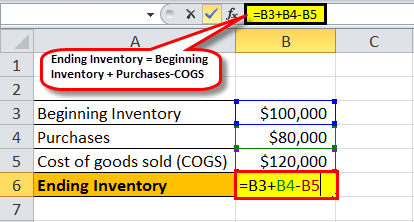

To calculate your in-process inventory the following WIP inventory formula is followed. Ending Inventory beginning inventory net purchases - prices of products sold Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net purchases and subtract the prices of products sold from their sum and you get the value for the ending inventory as shown below.

Ending Work In Process Double Entry Bookkeeping

In this equation WIP e ending work in process.

. Gross profit example 1. In this equation WIPe ending work in process. How do you calculate ending inventory units.

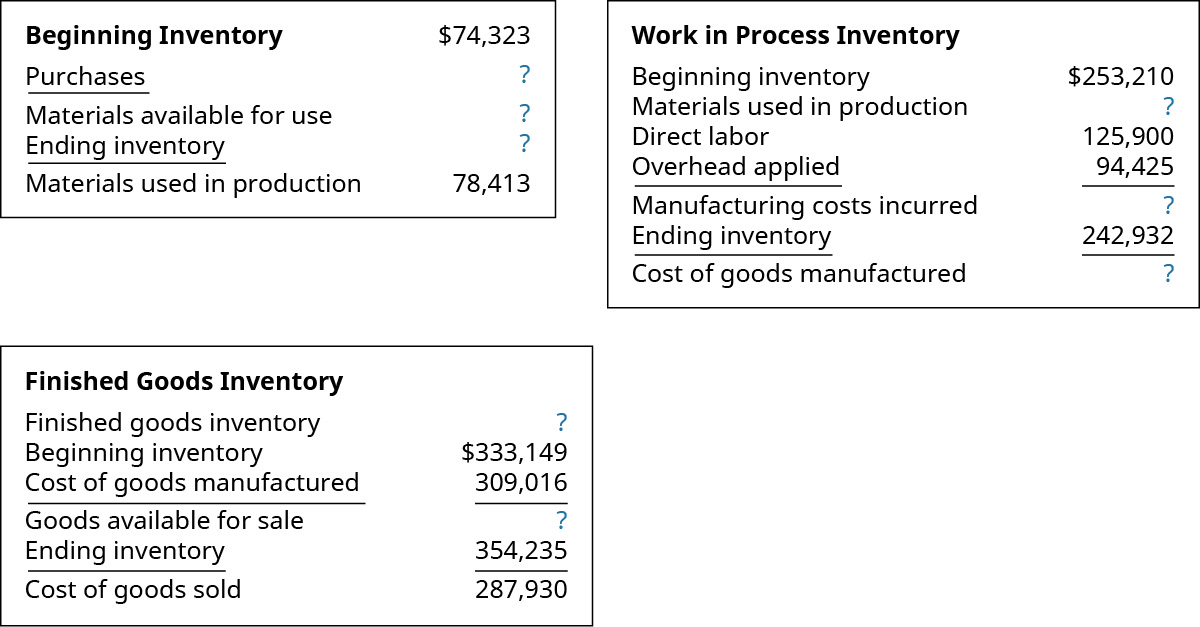

If the cost of the beginning work in process inventory is 85100 costs of goods manufactured is 965000 direct materials cost is 345000 direct labor cost is 225000 and overhead cost is 330000 calculate the ending work in process inventory. In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods. The work in process formula is expressed as.

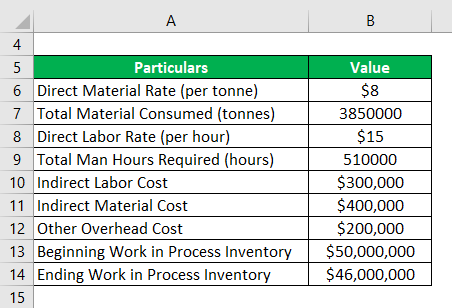

P4-42 Cole Company uses normal costing in. Has a beginning work in process inventory for the quarter of 10000. COGM 10000 100000 50000 60000 30000 190000 To learn more launch our free accounting courses.

Partially completed inventory is known as work in process is inventory. Calculate the ending Work in Process Inventory balance on June 30. WIP e WIP b C m - C c.

Begin by identifying the correct formula to calculate the ending work-in-process inventory on December 31 2017. Furthermore what is the cost of the ending work in process inventory. 30000 With this information we can solve for COGM which is on the credit side of the WIP Inventory T-Account.

And C c cost of goods completed. Work-in- process Work-in-process 112017 Total manufacturing cost - Cost of finished goods manuf. WIP inventory example 2 For a more comprehensive example lets say you run a shoe brand with a beginning WIP of 100000.

3 Methods to Calculate the Ending Inventory 1 FIFO First in First Out Method 2 LIFO Last in First Out Method 3 Weighted Average Cost Method. 12312017 The ending work-in-process inventory on December 31 2017 is 670000. Once these steps have been completed the expenses can be divided by.

Ignoring work in process calculations entirely. Click to see full answer. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

C m cost of manufacturing. WIP b beginning work in process. This inventory requires additional processing before it can be classified as finished goods inventory.

Expert Answer 100 1 rating. EBook Given the following information prepare a production report with materials added at the beginning and ending work in process inventory being 20 complete with regard to conversion costs. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods Lets use a best coffee roaster as an example.

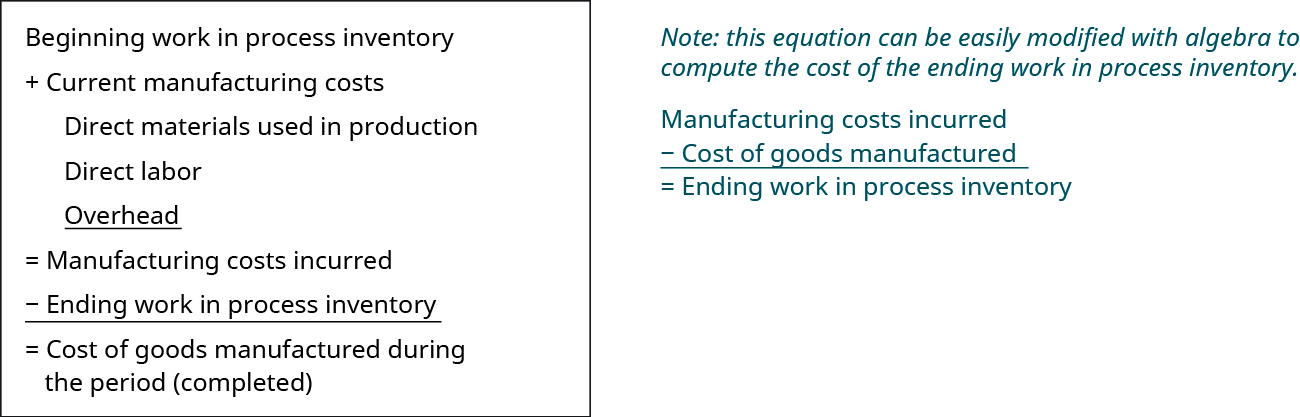

Using the steps above here are examples for the gross profit retail and work in process methods for calculating ending inventory. Multiply 1 expected gross profit by sales during the period to arrive at the estimated cost of goods sold. Beginning WIP DM DL MOH Cost of goods manufactured Ending WIP.

Subtract the value of finished goods from the previous period. The formula for ending work in process is relatively simple. Show transcribed image text Expert Answer Ending WIP Beginning WIP DM DL MOH Cost of goods manufactured Ending WIP 9505800 275412063 106674000 129915000 - 497911400 Ending.

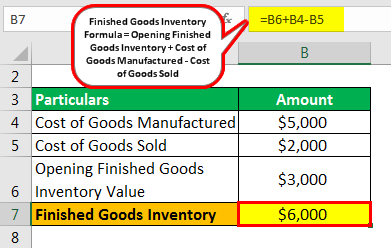

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory Work In-process Inventory Example Assume Company A manufactures perfume. Ending WIP Inventory Beginning WIP Inventory Production Costs Finished Goods Cost Work in process inventory formula in action Lets say you start the year with 10000 worth of raw materials. Subtract the estimated cost of goods sold step 2 from the cost of goods available for sale step 1 to arrive at the ending inventory.

Additional Business Financial. Beginning WIP Manufacturing Costs - Cost of Goods Manufactured Ending Work in Process. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory 110000 150000 250000 10000.

This leaves your ending WIP inventory as. Your WIP inventory formula would look like this. Ending Inventory 65000 - 45000.

So your ending work in process inventory is 10000. Formulas to Calculate Work in Process. Cm cost of manufacturing.

WIPb beginning work in process. Add the value of goods added to work-in-process during the previous period to the beginning work-in-process inventory in the previous period. Imagine BlueCart Coffee Co.

And Cc cost of goods completed. How to Calculate Ending Work In Process Inventory The work in process formula is. You incur 300000 in manufacturing costs and produce finished goods at a cost of 250000.

Find the cost of goods available Cost of good available Cost of beginning inventory Cost of all purchases 10000 5000 15000 Cost of goods available 15000 2. The last quarters ending work in process inventory stands at 10000. Calculate the balance in Work in Process at the end of the month.

Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period. Write down the beginning work-in-process inventory from the previous quarter. The calculation of ending work in process is.

The ending WIP beginning WIP manufacturing costs - cost of goods produced This represents the value of the partially completed inventory which accounts for only a part of what the company will actually produce. Most businesses that are not run by experienced operations management experts will have too much work in process.

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

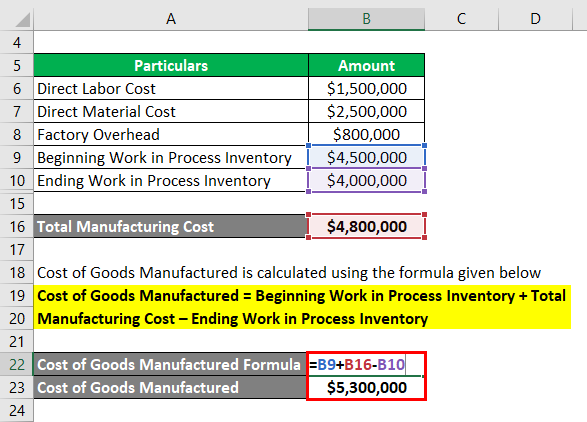

Cost Of Goods Manufactured Formula Examples With Excel Template

Finished Goods Inventory How To Calculate Finished Goods Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

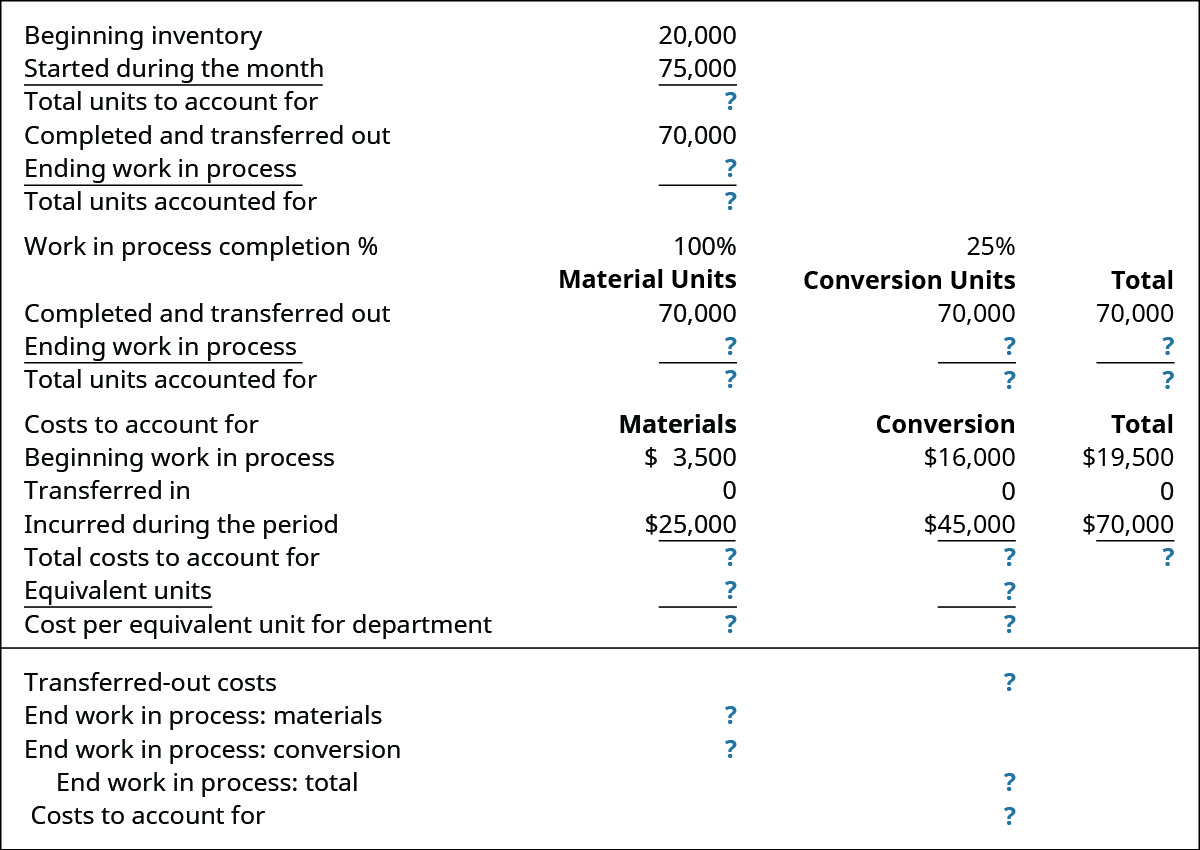

Explain And Compute Equivalent Units And Total Cost Of Production In A Subsequent Processing Stage Principles Of Accounting Volume 2 Managerial Accounting

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Wip Inventory Definition Examples Of Work In Progress Inventory

Work In Process Wip Inventory Youtube

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Dsm Chapter 18 With Explanations Flashcards Quizlet

Cost Of Goods Manufactured Formula Examples With Excel Template

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

Ending Inventory Formula Step By Step Calculation Examples

What Is Work In Process Wip Inventory How To Calculate It Ware2go